Applied Swing Systems Trading Home Study

This comprehensive home study course, featuring video recordings from a 2-day 2024 workshop, offers participants an in-depth understanding of Dr. Ken Long's Owl Swing Systems Template using the EdgeRater platform. EdgeRater is a powerful Windows-based software tool that enables traders to scan, backtest, and apply rule-based trading systems efficiently.

Designed for swing traders looking to enhance their strategies, this course focuses on the practical application of Dr. Long’s proven methodologies. Participants will learn how to leverage EdgeRater for signal generation and backtesting, empowering them to identify and execute trading opportunities based on price action.

Key outcomes of the course include:

Mastering Dr. Ken Long's Owl Swing Systems Template.

Effectively using EdgeRater for generating signals and validating trading strategies.

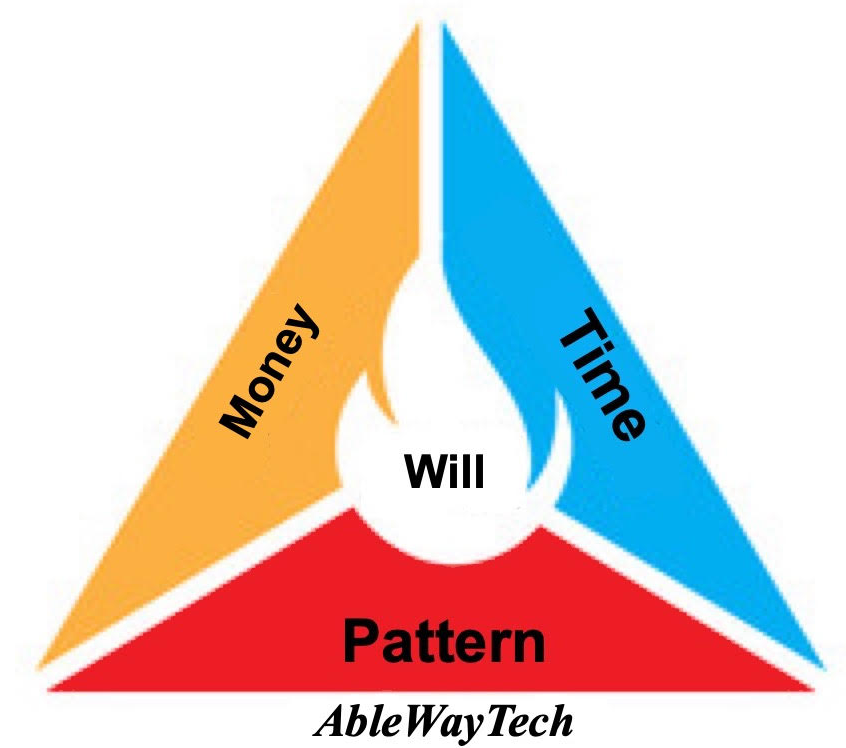

Enhancing decision-making with the Plan-Prepare-Execute-Assess framework.

Gaining valuable insights into market conditions, risk management, and trade assessment.

By the end of the course, participants will be equipped with practical skills to solve specific trading problems and improve their overall trading performance.

EdgeRater provides a 14 day free trial. EdgeRater operates on Windows PC.

MAC users will need to use Parallels Desktop for MAC. For more information: edgerater.com/ablewaytech

BONUS:

Receive Dr. Ken Long’s two latest ebooks: "Swingtrading Basics: Understanding the Herd" and “Mechanical Swing Trading” as bonuses.

Three recorded post-workshop Q&A sessions with Dr Ken Long

Don't miss this opportunity to enhance your trading skills with our comprehensive course, designed to provide you with the knowledge and confidence you need in the market.

student TESTIMONIALs

"Highly recommend for all that want to get better… are Masters at the craft…. contribution invaluable. HIghly recommend.” WR

“The OBUG group and the Applied Swing course have been outstanding, and the content continues to excel. One has to appreciate the instructors going above and beyond to bring all the insights together into strategies we can incubate,and to provide guidance on the nuances of which filters and exits to use for which objectives or under which conditions...” DB

Course Outline

Session 1: Foundational Understanding

Introduction and Overview:

Owl Trading Methodology:

EdgeRater’s Ken Long Swing Systems Template:

Swing Systems Rules

Scanning for Trades Using EdgeRater:

Backtesting the Swing Systems:

Q&A with Dr Ken Long

Session 2: Practical Implementation

Mechanical Versus Discretionary Trading:

Adding Discretion Appropriately:

Money Management

Mental Readiness

Putting It All Together with Trade Examples:

Trading Assessment

Summary and next steps

Q&A with Dr Ken Long

EdgeRater provides a 14 day free trial. EdgeRater operates on Windows PC.

MAC users will need to use Parallels Desktop for MAC. For more information: edgerater.com/ablewaytech

Course details

PART 1: Foundational understanding

Lesson 1: Introduction and Overview

Brief introduction to the course structure and objectives.

Introduction to the Owl Swing Trading Template in EdgeRater

Lesson 2: The Owl Trading Methodology

Overview of Dr Ken Long’s Owl Trading Methodology

Plan-Prepare-Execute-Assess Framework:

Plan: Reading the Market Conditions, Finding Candidates to trade

Prepare: Preparing trades with manageable risks, Proper mindset to trade

Execute: Trading the patterns, Entering and Exiting trades

Assess: Assessing trades post-execution, evaluating performance, and identifying areas for improvement.

Lesson 3: EdgeRater’s Ken Long Swing Systems Template

Detailed Exploration of the Template:

Overview of the Swing Systems Template and its purpose.

Explanation of key components within the template

Demo on how to use the template for initial setup.

Lesson 4: Swing Systems Rules

In-depth Discussion of the Rules:

Detailed breakdown of the 9 trading rules within the Swing Systems Template.

Explanation of the rationale behind each rule and how they contribute to successful swing trading.

Examples of how to apply these rules in different market scenarios.

Lesson 5: PLAN - Scanning for Trades Using EdgeRater

Practical Guidance on Scanning:

How to scan in EdgeRater to find potential swing trade opportunities

Walk-thru of a scanning session using historical market data

Identifying and interpreting scan results

Lesson 6: PLAN - Backtesting the Swing Systems

Importance and Execution of Backtesting:

Explanation of why backtesting is useful for validating trading strategies.

How to conduct backtests using EdgeRater, including selecting timeframes and relevant data.

Interpreting backtest results to assess the effectiveness of the Swing Systems Template.

Adjusting and optimizing trading rules based on backtest findings.

Batch testing and Monte-Carlo analysis

Lesson 7: Open Floor for Questions and Clarifications with Dr. Ken Long

Preview of Questions to be Answered: During this session, Dr. Ken Long will address the following key questions to provide deeper insights into the Swing Systems:

• Can you provide more details on how you developed the Owl Swing Trading Methodology?

• How did you arrive at the trading rules within the Swing Systems Template?

• Can you give examples of how you’ve applied these trading rules in various market conditions?

• What are some common mistakes traders make when scanning for trades?

• What metrics do you consider most important when evaluating the success of a trade?

Participants will also have the opportunity to ask their own questions during the session.

pART 2: practical implementation

Lesson 8: PREPARE- Mechanical Versus Discretionary Trading

Differences: Understanding the fundamental differences between mechanical (rules-based) and discretionary (judgment-based) trading approaches.

Pros and Cons: Evaluating the advantages and disadvantages of each approach, including consistency, flexibility, emotional control, and adaptability.

Rules-based discretionary trading

Lesson 9: PREPARE - How Do We Add Discretion Appropriately?

Using the Kata Challenge (KC) Framework: Introducing the Kata Challenge framework to effectively integrate discretionary elements within a mechanical trading system.

Introducing the Indicators: Detailed explanation of the indicators used in the KC framework and how they support decision-making.

Advantages of Using the KC Framework

Patterns of the KC Layout: Kata2

Flexible Exits: Slide on the three speeds of exits (fast, medium, slow) to manage trades effectively.

Lession 10: PREPARE - Money Management

Insights and wisdom from prominent traders like Buzzy Schwartz, Paul Tudor Jones, Van K. Tharp, and Ken Long on money management.

Core Position Sizing Model with Example: Detailed explanation of a position sizing model, including practical examples.

Portfolio Heat Principles and Correlations: Managing portfolio risk through understanding correlations among assets.

Lesson 11: PREPARE - Mental Readiness

Definition and discussion of the ideal mental state for trading, the “Zero State”.

Mental Preparation using the Parts Model: How mental preparation is imperative to good trading. Explanation of the parts model to understand different aspects of a trader’s mindset.

Application Using a Meditation Exercise: Meditation technique to increase awareness, promote calmness, and maintain focus and emotional control.

Suggested resources including literature, videos, and blog articles from Ablewaytech

Lesson 12: EXECUTE - Putting It All Together with Trade Examples

Walk-through from trade scanning in EdgeRater to symbol selection, trade framing and execution of trades using bar-by-bar examples.

Application of mechanical entries and exits, as well as discretionary exit strategies and the Kata2 long pattern.

A detailed sample of a mechanical swing trading plan, including a ‘recipe’ of daily procedures to apply.

Lesson 13: ASSESS – Trade Assessment

Main Data Analysis Methods: Utilizing descriptive statistics and multiple graphs as standard analysis methods to evaluate trading performance.

Example of the assessment process using the results of a swing trading back test in EdgeRater.

Ideas for Improvements: Strategies to address common issues such as low win rates, low average wins, and large losses.

Introduction to sample set analysis for continuous improvement and refinement of trading strategies. Explanation of the important benefits of trading in sample sets.

Lesson 14: Open Floor for Questions and Clarifications with Dr Ken Long

Participants can ask questions and seek clarifications on the day’s topics

Join Our Thriving user group:

Our Owl Bundle User Group (OBUG) members meet via Zoom on a weekly basis to study various trading strategies on the Thinkorswim and EdgeRater platforms. These meetings serve as a forum for knowledge sharing, where experienced Owl traders discuss strategies, insights, and market trends. By participating in these sessions, you'll gain valuable knowledge and be able to interact with fellow traders who are part of our thriving community.

Additionally, we have recorded all our prior meetings, ensuring that you won't miss out on any of the valuable content even if you can't attend live. These recordings cover a wide range of topics, including swing systems, filters and scans, market analysis techniques, and much more. By accessing this extensive library of recordings, you'll be able to learn at your own pace and delve into subjects that interest you the most.

We invite you to join our thriving community of Owl traders. By doing so, you'll gain access to a wealth of knowledge, valuable recordings, and the opportunity to connect with experienced traders who can help elevate your trading to new heights. Don't miss out on this opportunity to enhance your trading journey and success.

More Information: HERE

Contact admin.support@ablewaytech.com for more information.