By Philip Wu, CMT

In the Plan phase we seek to find stocks to trade from our watchlist that are in “critical states,” like coiled springs, that are about to move higher or lower faster than usual. Our watchlist in this example contains 12 stocks – AA, AAPL, CLF, DVN, EWZ, JPM, NVDA, PFE, TSLA, UNG, X. These stocks cover the sectors that we reviewed earlier in the plan phase. Having 12 symbols to follow is small enough for us to know how they behave in markets but diverse sufficient to apply selection filters to pick the best candidates.

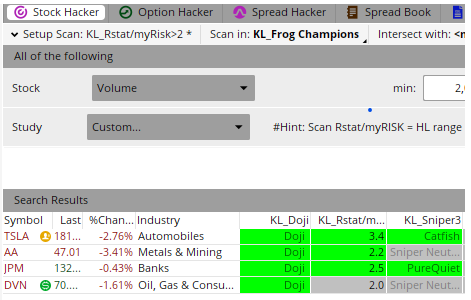

We will use the Thinkorswim Scan function to help narrow the list of symbols to trade the next day. Our selection filter is to “find the movers” to avoid being chopped in and out of trades with non-trending stocks. For this example, we decided to use the filter: (Rstat/MyRisk) > 2, and show Doji, and Sniper setups as additional selection criteria. These filters find symbols in a compressed state that are about to move. Rstat/MyRisk is the ratio of maximum reasonable intraday move divided by MyRisk, to find “squeezed” candidates with reward to risk greater than 2. The Doji is a well-known term identifying a price in a compressed state. The Sniper setups looks for abnormal price location over the past 10, 30, 150-day lookback periods, and Z scores of its 5-day range over the past 150 periods. We see from our original list of 12 symbols that TSLA, AA, JPM, and DVN are potential trade candidates after Scan filtering.

From this list of 4 candidates, we note that the RL30 sectors for TSLA, AA, and DVN sectors are still rising, whereas the JPM sector is peaking. Based on “Logic chain”: Market-> Sector -> Symbol market assessment from an earlier analysis, this suggests a bullish leaning on TSLA, AA, DVN and a bearish leaning on JPM. However, price is the final arbiter in intraday trading, and the market condition is a supplemental consideration. Let’s choose TSLA, AA, and DVN as our candidates and move on to the Prepare phase.