Today I’d like to go through an example of how we can use our logic chain concept to do a top-down analysis of the market to find symbols in a critical state that we can be ready to trade the next day. In the Owl Group we use a “plan, prepare, execute, assess” process for trading in a systematic and professional way. A large part of the ‘prepare’ phase consists of having reliable ways to find targets.

"Find the Movers" with Top Down Analysis

As an update to our prior article on our Thinkorswim trading user group, we will be embarking the next several weeks on “Finding the movers”. Based on feedback from our members, we will be focusing on identifying trade candidates based on the top down “Logic chain” strategy as developed by Dr Ken Long.

"Enhancing Trading Efficiency: Exploring New Applications in the Owl Bundle on Thinkorswim"

In the past three weeks, our focus has been on studying the Thinkscript language and this article is an update on the new applications we have developed for "finding the movers." To provide some background, the Thinkscript language offers customization options in five different areas of the Thinkorswim platform: 1) Filters for the watchlist columns, 2) Indicator studies, 3) Backtesting strategies, 4) Scans and Alerts, and 5) Conditional orders based on technical studies. In this blog article, we will highlight a few examples to illustrate these applications.

Empowering Traders: Join the Owl Bundle User Group Meetings on Thinkorswim

As a trader, staying ahead of the game and continuously honing your skills is essential for success in the fast-paced world of finacial markets. The Owl Bundlie User Group Meetings on Thinkorswim provide an invaluable opportunity for traders to gather, share knowledge, and enhance their trading strategies. With a growing community of members and a series of recorded sessions, this user group offers valuable insights and practical lessons. Whether you're a seasoned trader or just starting out, these meetings can signficantly impact your trading journey.

Enhancing Your Trading Strategies: Insights from Quantitative Analysis

As traders, we are always looking for ways to improve our trading strategies and achieve greater profitability. In this blog article, we will share the insights obtained from a quantitative analysis conducted in our Owl Group user meetings. We focused on studying six different strategies using the Owl Bundle on Thinkorswim and the Thinkorswim strategy backtest capabilities.

"Thinkorswim User Group for the Owl Bundle: Fostering a Community of Traders"

Our Thinkorswim user group for the Owl Bundle has been meeting weekly and it has been a great platform for us to exchange ideas, information, insights, and strategies with one another. The members are sharing helpful tips and tricks while also assisting each other with common problems. Through this user group, a sense of community and belonging is being fostered, allowing traders to connect with like-minded individuals who share a passion for trading.

My Favorite Symbols to Trade and How I Find Them

In this article I’d like to talk about the process of finding symbols to trade each day. This can be applied to any timeframe really, because whether I’m conscious of it or not I have some reason for selecting a symbol to trade. Whether I plan to hold it for ten years or ten minutes, there was some thought process I went through to decide on that symbol.

Trade planning as a key success factor

It’s important to have a systematic trading process in planning your trades. In our weekly Owl Bundle on Thinkorswim user group Zoom meeting, an experienced trader shared how he plans on which symbols to trade the next day. I was very impressed with his systematic approach to trade planning starting first with an understanding of the market.

Find the Movers using the "Godzilla"

Finding Trade Opportunities with Top Down Analysis

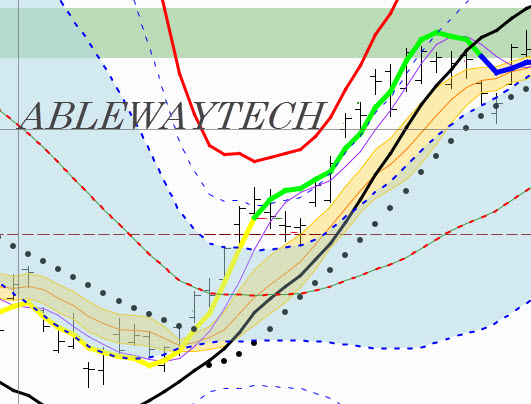

Let's use the Owl Bundle on Thinkorswim to identify short term trade opportunities, To achieve this, we will begin with a market view and then compare various sectors to identify the one with the most abnormal condition. Next, we will examine the top ten holdings within the chosen sector to determine which ones are in a compounded critical state that are about to pop higher or lower quickly. The Owl Bundle on Thinkorswim comes programmed with indicators and metrics developed by Dr. Ken Long, aimed at finding trading opportunities.

Analysis of Last Week's Find the Movers trades

Find the movers 2/24/2023: NKE and TSLA

When using the Owl Bundle on Thinkorswim to identify trade opportunities, we adopt a "Logic chain" approach that involves analyzing sectors and the symbols within them. To do this, we examine the S&P500 sector ETFs and rank them according to Rstat/MyRisk from highest to lowest. In our analysis, XLY, XLK, and XLC emerged as the top three symbols

Sensitivity Analysis of Trading Strategies on Thinkorswim

Backtesting your trading skills with Thinkorswim OnDemand

This blog will describe how to evaluate your trading skills through Thinkorswim OnDemand features. The Thinkorswim OnDemand allows you to move back in time to do simulated trades using all your trading indicators and setups. Thinkorswim has stored all the historical price and options data for the last decade that allows you to practice your trades with tick, minute, daily, weekly, or monthly timeframes.

Backtesting strategies on Thinkorswim desktop

So, you have a trading strategy and are wondering how it would perform, or you may wonder which exit approach is best for your trading strategy. Thinkorswim “Strategies” is a back-testing capability to provide you with historical buy and sell signals on your chart based on your strategy rules, as well as provide a graphical and table report that shows the hypothetical profit/loss of your trading strategy.